Blockchain has brought about seismic shifts in the way we perceive traditional finance. It is the precursor to decentralized finance (DeFi). The technology is enabling financial services without reliance on central institutions or intermediaries. This is ushering in a new era of digital assets set to change even established financial aspects like banking for the better.

Deloitte’s latest report – based on a survey of senior executives and practitioners from around the world – states the same.

Based on a poll of a sample of 1,280 executives in 10 locations, Deloitte’s 2021 Global Blockchain Survey finds a growing consensus. A consensus around the increasing value of digital assets as the future of banking.

According to many of these decision-makers, banks will have to embrace a transition to digital assets, sooner or later.

It is well known that the banking sector has been slow to adapt to blockchain and digital assets. Many on the other side of the table also question the volatility and decentralization associated with the technology. They wonder how viable digital assets can turn out to be for a system as rigid as traditional banking.

However, financial leaders from around the world strongly believe that this is not only the future but also an inevitable one. According to 76% of respondents, fiat currencies will either be completely replaced by digital assets within the next 5 to 10 years. This will make way for disruptive, unconventional digital assets.

80% of Deloitte’s poll respondents concur that blockchain, digital assets, and cryptocurrency solutions will open new revenue streams for their respective industries. And they welcome this diversification as a much-needed respite.

Add to that their views on how digital assets can be the key to gaining a competitive advantage. Blockchain and web3 are very much the “defining” aspects of the next decade. Losing out on these technologies could prove fatal when it comes to standing in (if not ahead of) the league.

The case for digital assets is strong for other reasons as well. Blockchain technology has proven useful in countering sluggish payment systems and high rates. A decentralized ledger can help save trillions of dollars lost in inefficient structures.

At the same time, blockchain helps do away with the need for gatekeepers in the loan and credit sector. This may result in cheaper interest rates and more borrowing security. Lending powered by blockchain may make it possible to offer loans to a bigger customer base.

While the Deloitte Report outlines the importance of digital assets for FSI and banking, other experts also resonate with the views. A Goldman Sachs interview explores the US chief economist’s view on why banks are considering digital currencies today. In the video, David Mericle throws light on the potential implications of digital assets for monetary and fiscal policies.

In another story by BBC, Gautam Jain, Global Head of Digitization and Client Access at Standard Chartered Bank, comments on the revolutionary aspect of blockchain. He is of the view that banks can leverage this advancement “to make global trade and financial services much stronger.”

A BNY Mellon Report goes on to discuss the evolution of digital assets in shaping the financial ecosystem globally. It also delves deeper into the right infrastructure and collaboration mechanisms that must be encouraged.

Digital assets have the potential to not just transform processes, but also components and stakeholders in conventional banking.

Banks and other financial institutions that are digital natives have all been quite active lately in trying to get into the digital assets market. The buzz may imply a large take-up in the longer term and a sharp acceleration of institutional participation over the next few years. Some of the key trends in this light are as follows:

Blockchain is enabling a new paradigm of digitization in finance. It will have long-lasting impacts on banking systems around the world. For successful integration, digital assets must come with the same trust, soundness, and safety standards as traditional assets.

It is also critical to consider the readiness of the institutions themselves. This is important if we want an ecosystem that is resilient, risk-averse, and regulated. There should be seamless systems to ease scalability and safekeeping in the long run as well.

While the expectations continue, it wouldn’t be wrong to call the current climate highly favorable for digital assets. Institutional readiness and leadership sentiment in the matter are already welcoming. The ecosystem presents significant prospects for growth as well. The focus should be on innovation, trust, and collaboration to take this forward.

The banking industry has been known to take a while to adopt blockchain technology and digital assets. The world’s financial echelons, however, are adamant that this is not only the future but also an unavoidable one. The defining elements of the coming decade are undoubtedly blockchain and Web3, and they will also disrupt traditional banking systems as we know it.

The catch: Digital assets must meet the same standards for reliability, security, and trust as traditional assets in order for integration to be successful.

Ian Scarffe is a serial entrepreneur, investor, key opinion leader and Blockchain consultant with business experience from around the world. An expert in Startup, Investment, Fintech, Web3 and Blockchain industries. Ian currently consults and advises for a range of multi-million dollar companies. Ian’s overall mission is to foster a society of economically independent individuals who are engaged citizens, contributing to the improvement of their communities across the world.

Apple’s new AI model leverages Apple Watch behavior data—like activity, sleep, and mobility—to deliver more accurate, early health predictions and insights.

Microsoft is investing $4 billion in Elevate, aiming to train 20 million people worldwide in AI skills. The program offers accessible education, credentials, and global partnerships to prepare the workforce for an AI-driven future.

Discover how the AI boom is pushing the U.S. power grid to its limits, raising energy costs and prompting urgent upgrades in infrastructure and policy.

After spinning out from Intel, RealSense secures $50 million in funding to accelerate advancements in AI vision and robotics. Learn what this means for the future of automation and intelligent systems.

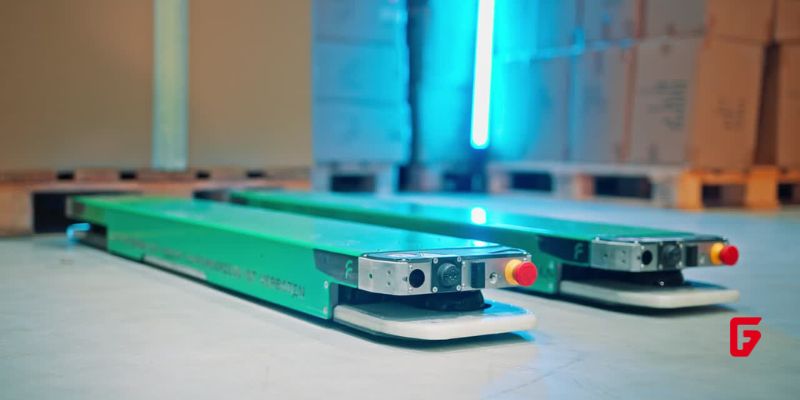

Filics has closed a €13.5M funding round to accelerate the development and international expansion of its autonomous warehouse robots, targeting efficient logistics and intralogistics innovation.

Amazon Web Services will debut its Agentic AI Marketplace next week, featuring Anthropic’s advanced AI. Learn how this move could reshape enterprise AI adoption and innovation.

Google Gemini AI introduces a photo-to-video feature, enabling users to create dynamic 8-second video clips with sound from images. Available for Ultra and Pro subscribers, this tool is powered by Veo 3 and brings new creative possibilities for content creators.

Varda Space has secured $187 million in funding to boost its space-based drug development program, targeting pharmaceutical breakthroughs and commercial launches by 2025.

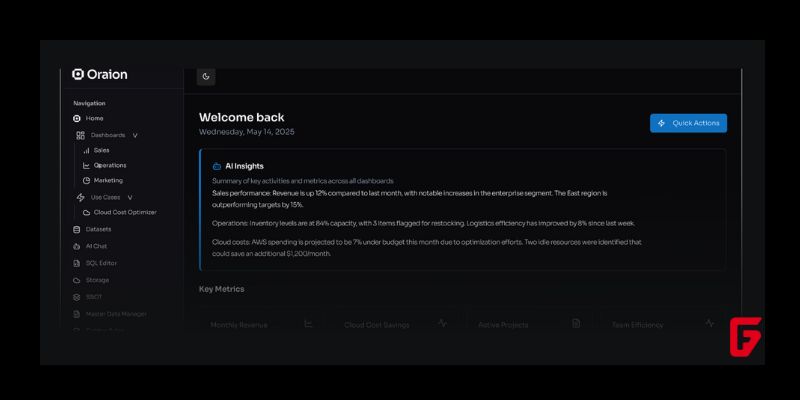

Irish AI startup Oraion has raised €2.9 million in pre-seed funding to expand into the U.S. market and accelerate development of its enterprise automation platform.

NEURA Robotics and Hyundai are teaming up to deploy advanced cognitive robots in shipbuilding, aiming to solve labor shortages and set new standards in automation, safety, and productivity.

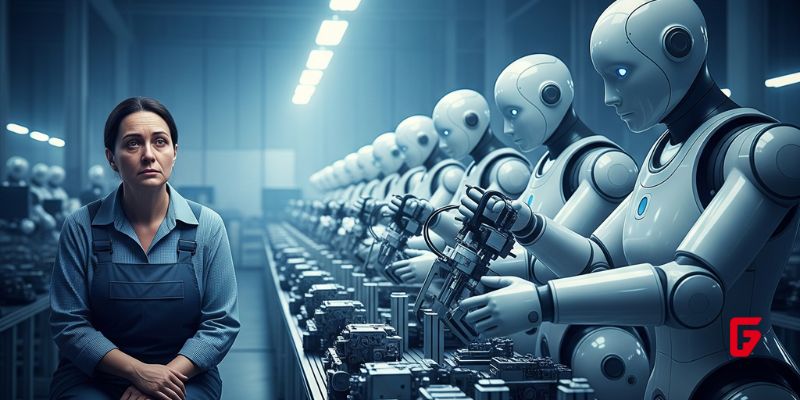

Discover how rapid AI advancements may soon replace traditional jobs, disrupt global economies, and drive the need for new income models like UBI.

UBTECH’s Walker S2 sets a new standard in robotics with autonomous battery swapping and continuous 24/7 operation. Explore what makes this humanoid robot a breakthrough in automation.

futureTEKnow is focused on identifying and promoting creators, disruptors and innovators, and serving as a vital resource for those interested in the latest advancements in technology.

© 2025 All Rights Reserved.

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Thanks for visiting futureTEKnow.